Murakami Prints: The Cultural Catalyst for Tokenized Trading

As cultural assets move onchain, not all art behaves equally. Some pieces sit in vaults. Others move culture forward.

Murakami prints do both.

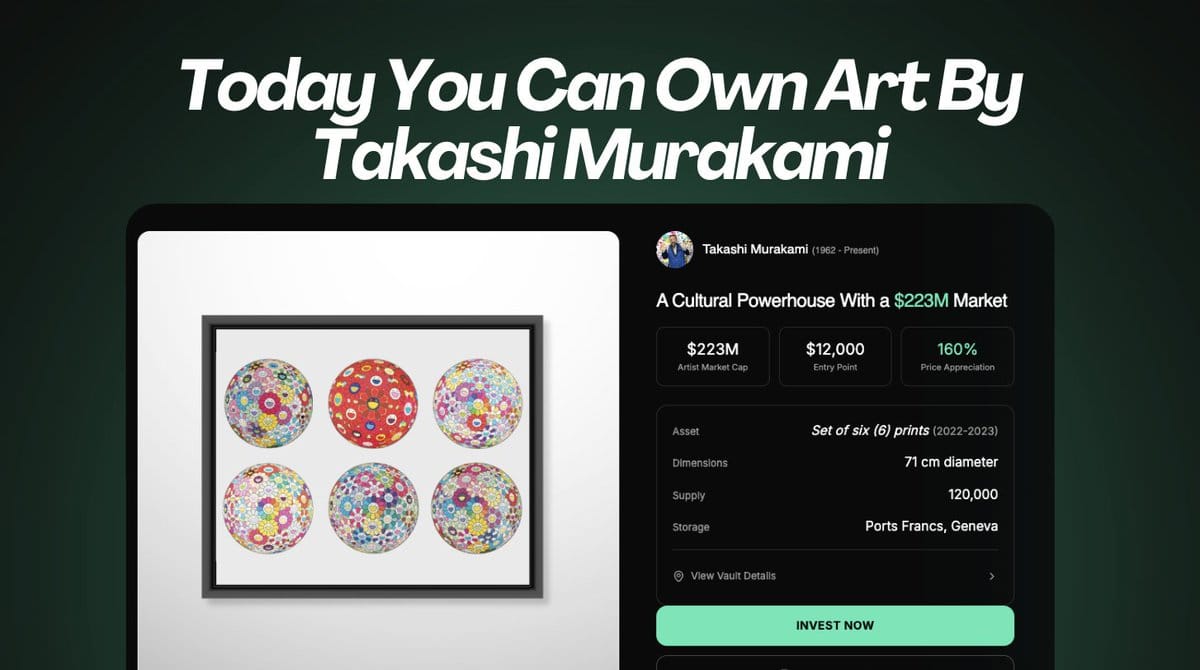

With the launch of $MURFLO on LiveArt — the token tied to Takashi Murakami’s Set of Six Flower Prints — we’ve brought one of the most liquid, recognizable, and emotionally resonant segments of contemporary art directly into the onchain economy.

Murakami: A $200M Art Market Legend

Takashi Murakami is among the most traded contemporary artists globally, with a cultural reach that spans fine art, fashion, and global media. His Flower Ball and smiling daisies aren’t just visual signatures — they’re global brand assets.

The Murakami print market alone has:

- A $200M+ footprint in primary and secondary markets

- High turnover across top-tier auctions and private sales

- A price range ($1K–$10K) that blends prestige with accessibility

Now, that market energy is onchain — live on LiveArt’s trading platform and priced for velocity.

Stability + Liquidity = Ideal Onchain Behavior

What makes Murakami prints ideal for tokenization?

Unlike traditional fine art, they behave like premium collectibles with financial visibility:

- Frequent sales across New York, Hong Kong, London, and Paris

- Tight price bands and resilient demand, even in cooling macro cycles

- Ongoing visibility through fashion collaborations, museum shows, and pop-up activations

Murakami prints don’t just appreciate — they move. And that makes them the perfect candidate for fractionalization, real-time price discovery, and secondary trading.

Cultural Demand Powers Market Momentum

The value of Murakami prints is driven not just by auctions, but by cultural relevance:

- Louis Vuitton × Murakami anniversary re-editions

- Selfridges London & SoHo pop-ups featuring immersive experiences

- Major museum exhibitions across the U.S. and Asia

- Global Gen-Z and millennial demand spanning art, streetwear, gaming, and social

This is the energy that fuels tokenized culture — not passive store-of-value behavior, but active, global participation.

Fractional Ownership with Prestige

Each Set of Six Flower Prints brings:

- Clear cultural identity

- Democratized entry points

- Continuous trading potential

With $MURFLO, collectors can participate in the Murakami market without needing five figures of capital — but still access the same emotional and cultural upside.

This is real-world art as liquid cultural currency.

Community Signals Are Strong

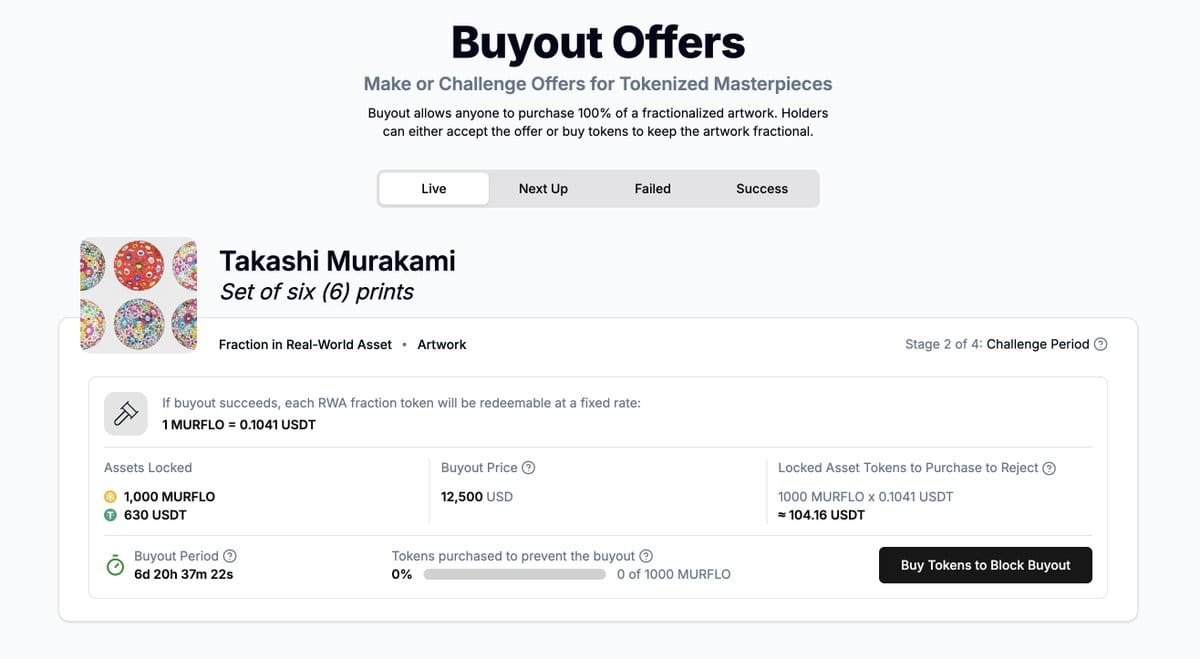

Since launch, the $MURFLO token has seen early buyout activity — a clear sign of market interest. But what’s more telling is what happened next:

Holders blocked the buyout.

Instead of exiting, the community doubled down — choosing to keep the asset in circulation, preserve price discovery, and continue secondary trading.

This is conviction. This is culture staying onchain.

Why It Matters for RWAfi

Murakami prints give tokenized real-world assets the attributes the next wave of users actually care about:

- Emotional resonance

- Status signaling

- Brand familiarity

- Resale liquidity

- Cultural narrative

In a world of slow-moving fine art and inaccessible trophies, Murakami prints are different.

They’re art you know, value you can track, and culture you can trade.

Bottom Line

Murakami prints are the ideal unit of culture for the tokenized era.

They represent the intersection of collector demand, brand power, and onchain utility — and they’re live now.