LiveArt Roadmap Unveiled: The Future of Wealth Creation is AI-Driven

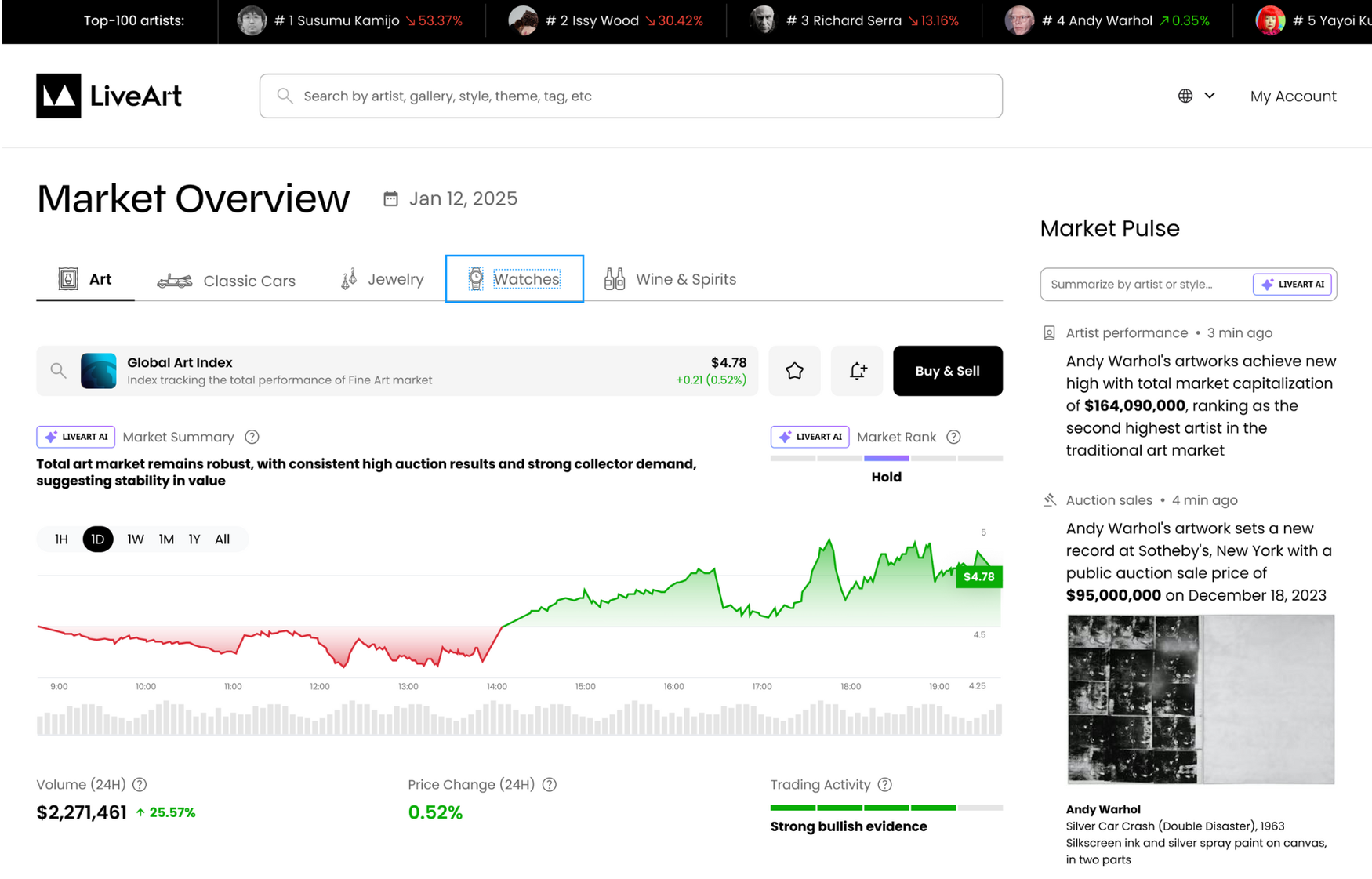

LiveArt is revolutionizing the ownership, trading, and investment of art and high-value collectibles through AI-powered Real-World Asset (RWA) tokenization. This is a $10 trillion asset class, one of the largest and best-performing in the world, and LiveArt is unlocking its liquidity through its cutting-edge blockchain and AI platform.

For years, elite investment firms and insiders have had exclusive access to the best opportunities. High-value assets—like fine art, luxury watches, rare wines, and classic cars—have been difficult to access, trade, and accurately price. Market insights were hidden behind expensive reports and closed networks, keeping everyday investors out.

LiveArt tears down these barriers

Bringing AI-driven discovery, transparent pricing, and onchain liquidity to everyday investors.

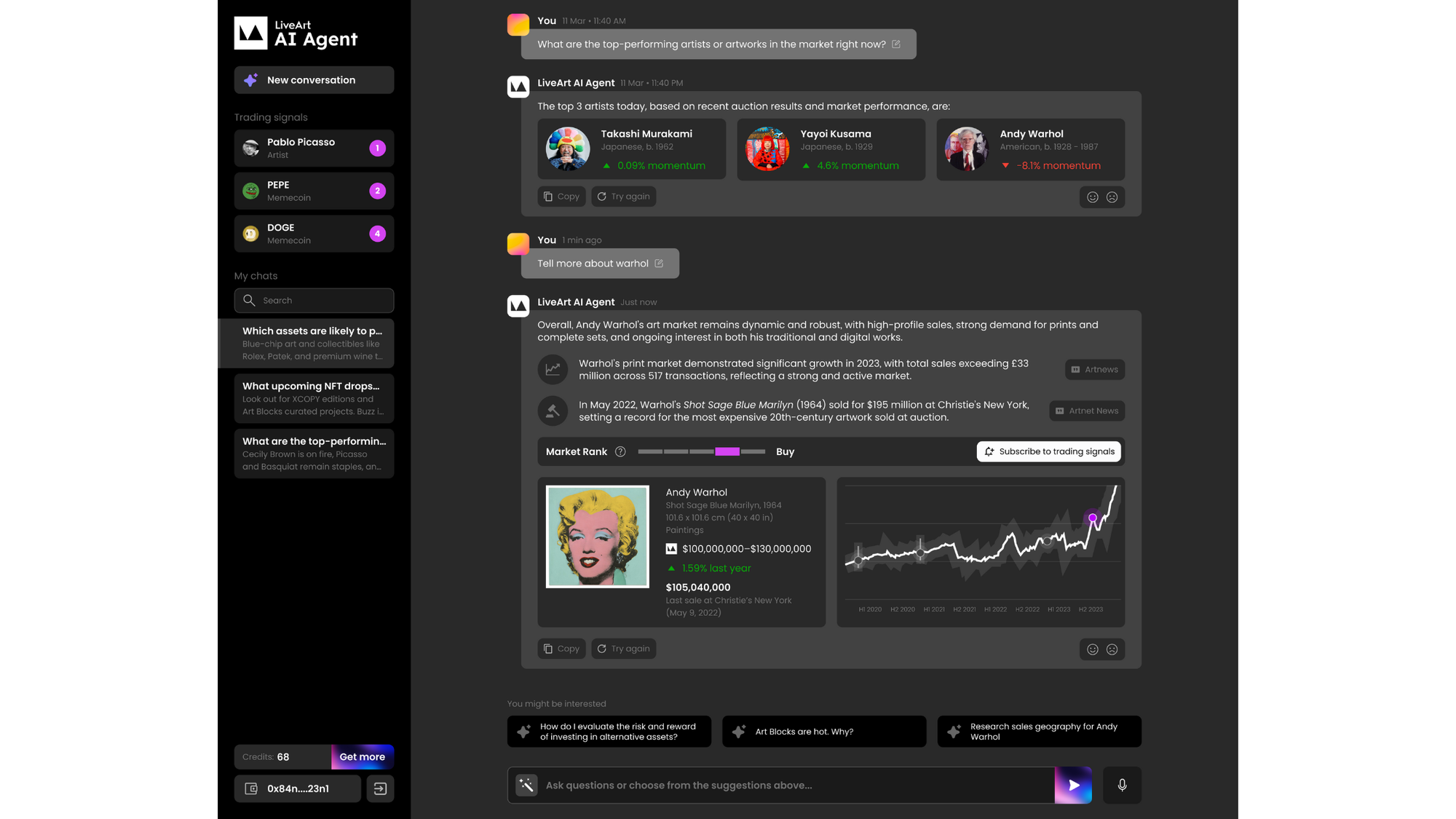

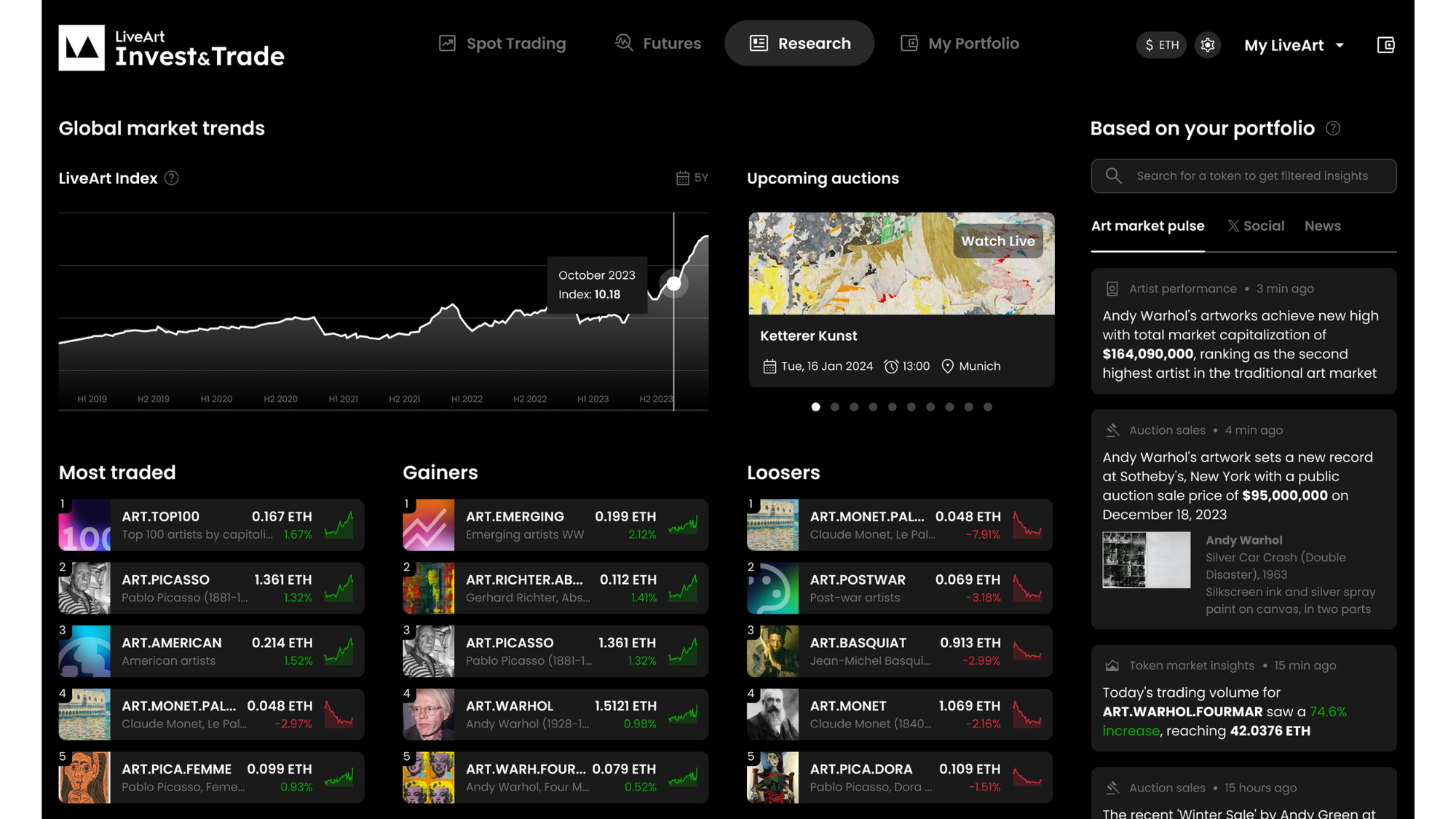

- At the core of this transformation is the LiveArt AI Agent, an advanced AI system that analyzes global market data to identify, price, and manage top-quality assets across art, watches, cars, fine wine, and more.

- LiveArt is the #1 provider of art & luxury market data, transforming insights into AI-powered trading signals, ensuring informed and profitable investments.

- LiveArt tokenizes and fractionalizes assets into Shards, conducting onchain Initial Asset Offerings (IAOs) that reach 13M+ members and a 30M+ user network through multi-chain partnerships.

- LiveArt roadmap includes the launch of ArtChain, with $ART as its native token, powering AI-driven price discovery, trading, and portfolio management.

- With a target of $1B AUM in three years, LiveArt is defining the future of AI-powered tokenized high-value assets.

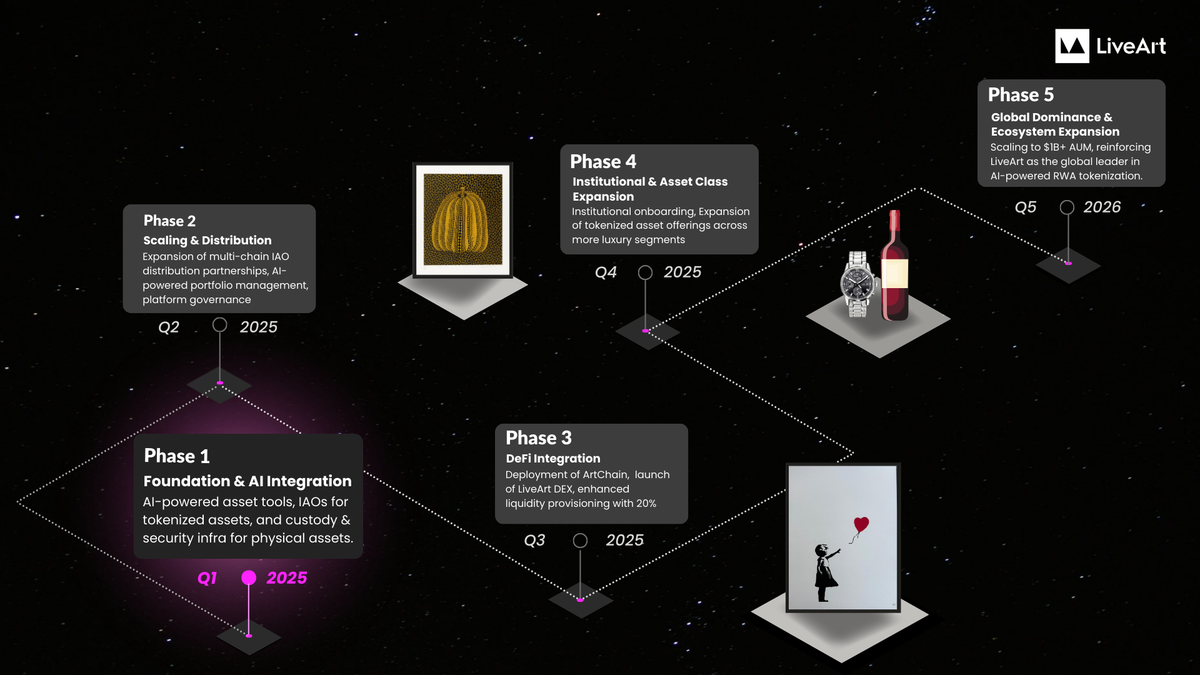

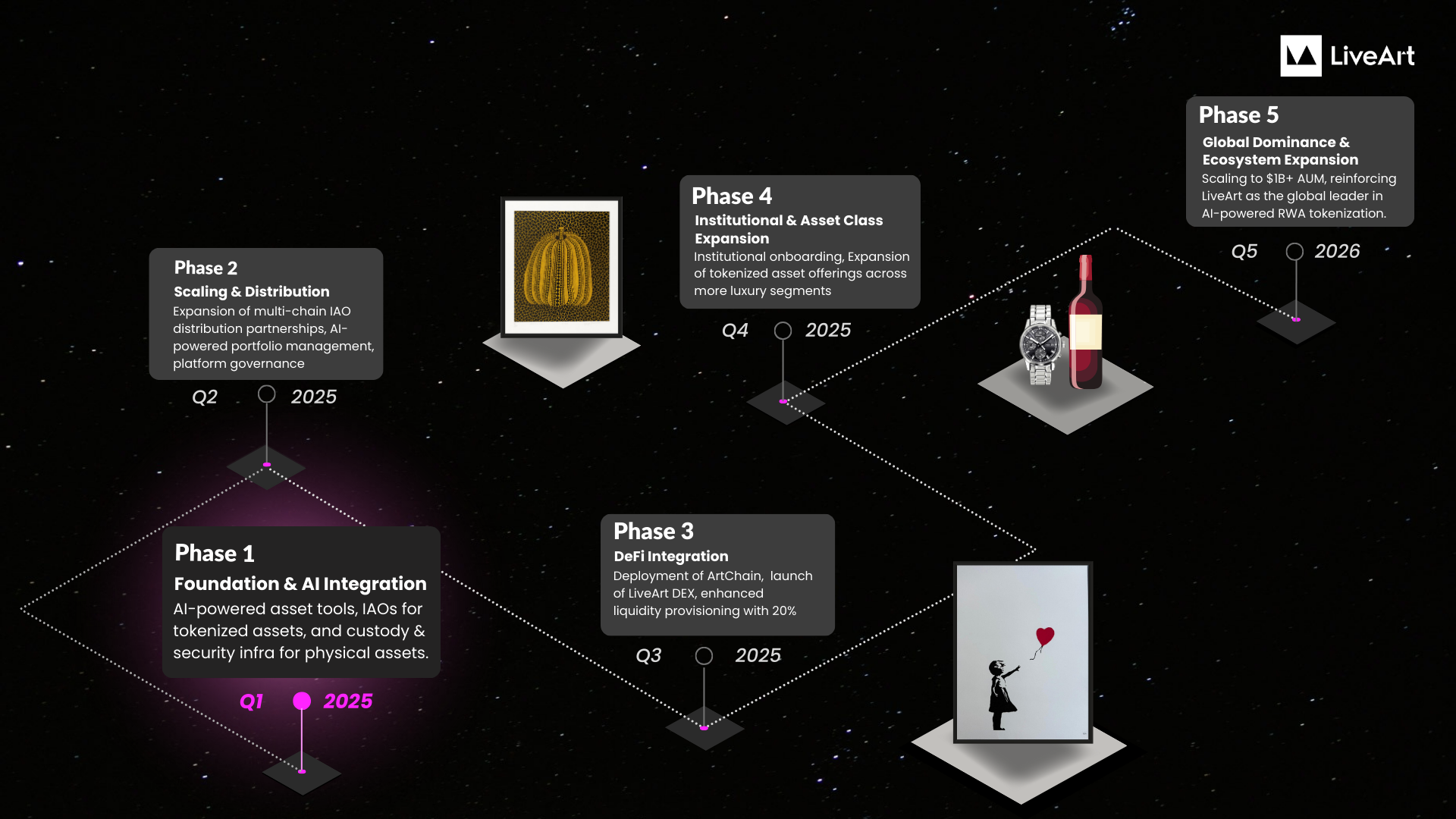

LiveArt Roadmap

Phase 1: Foundation & AI Integration (Q1 2025)

- Launch of LiveArt AI Agent for asset discovery, pricing, and investment recommendations.

- Expansion of data intelligence capabilities, strengthening AI-driven market insights.

- First wave of Initial Asset Offerings (IAOs) for tokenized art & luxury assets.

- Establish custody & security infrastructure for physical assets in freeports.

Phase 2: Scaling & Distribution (Q2 2025)

- Expansion of multi-chain IAO distribution partnerships, increasing global investor access.

- AI-powered automated portfolio management tools for investors.

- Integration of LayerZero’s OFT standard for seamless cross-chain interoperability.

- Launch of governance mechanisms for $ART stakers to participate in ecosystem decisions.

Phase 3: DeFi Integration (Q3 2025)

- Deployment of ArtChain, with $ART as the native token.

- Launch of LiveArt DEX for AI-assisted secondary trading of fractionalized RWAs.

- Enhanced liquidity provisioning with a portion of each IAO reserved for the DEX liquidity pool.

Phase 4: Institutional & Asset Class Expansion (Q4 2025)

- Institutional onboarding: hedge funds, family offices, and crypto-native asset managers.

- Expansion of tokenized asset offerings across more luxury segments (classic cars, fine wine, rare watches, etc.)

- Introduction of AI-driven DeFi structured products: RWA-backed indices, funds, and lending solutions.

Phase 5: Global Dominance & Ecosystem Expansion (2026 and beyond)

- Scaling to $1B+ AUM, reinforcing LiveArt as the global leader in AI-powered RWA tokenization.

- AI-driven real-time asset valuation models for institutional and retail investors.

- Full deployment of on-chain art & luxury financial services, bridging traditional finance with Web3.

- Further expansion into global markets, leveraging AI to predict demand trends and optimize asset distribution.

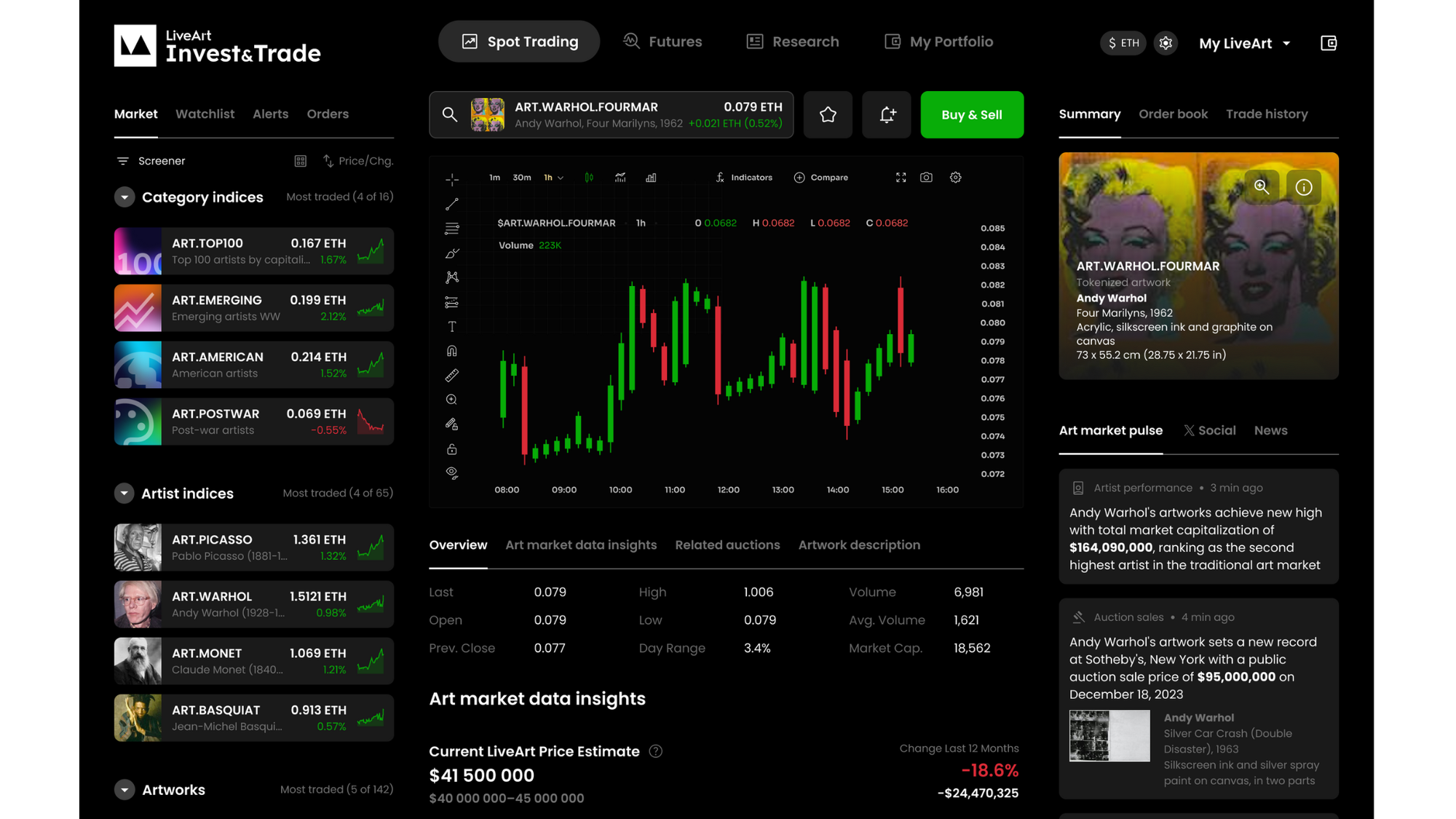

How LiveArt Works

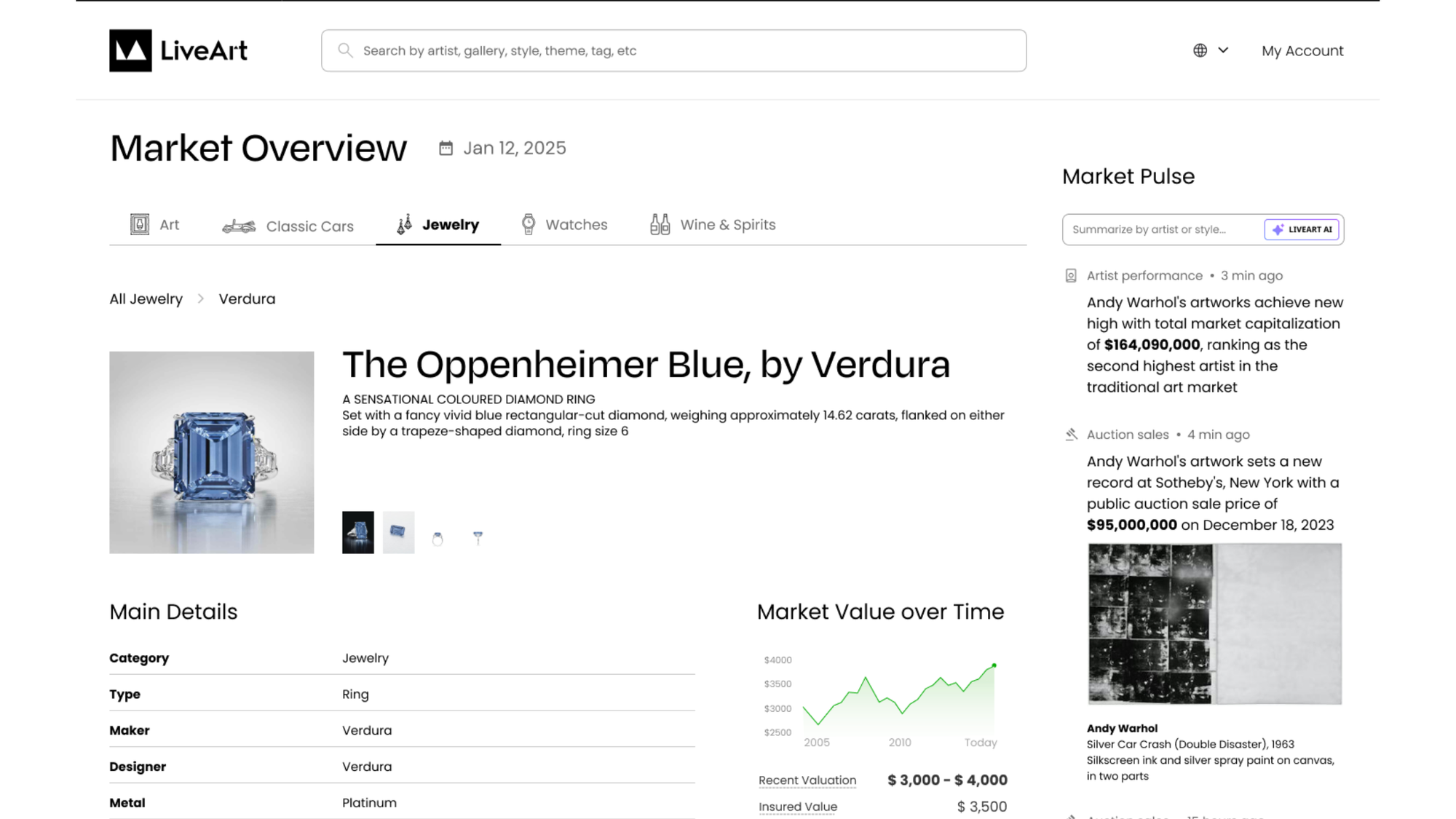

LiveArt identifies high-value assets across fine art, luxury watches, classic cars, fine wine, and jewelry through a global network of collectors, dealers, galleries, and auction houses. These assets are selected based on investment potential, rarity, and demand within both traditional and blockchain markets.

1. AI-Driven Asset Sourcing & Selection

At the core of this process is the LiveArt AI Agent, which continuously scans market data, historical sales records, and price trends to pinpoint undervalued opportunities. The AI evaluates factors such as artist reputation, previous auction performance, and macroeconomic conditions to recommend acquisitions with the highest potential upside. This AI-driven approach ensures LiveArt secures top-tier assets for tokenization while maximizing investor confidence.

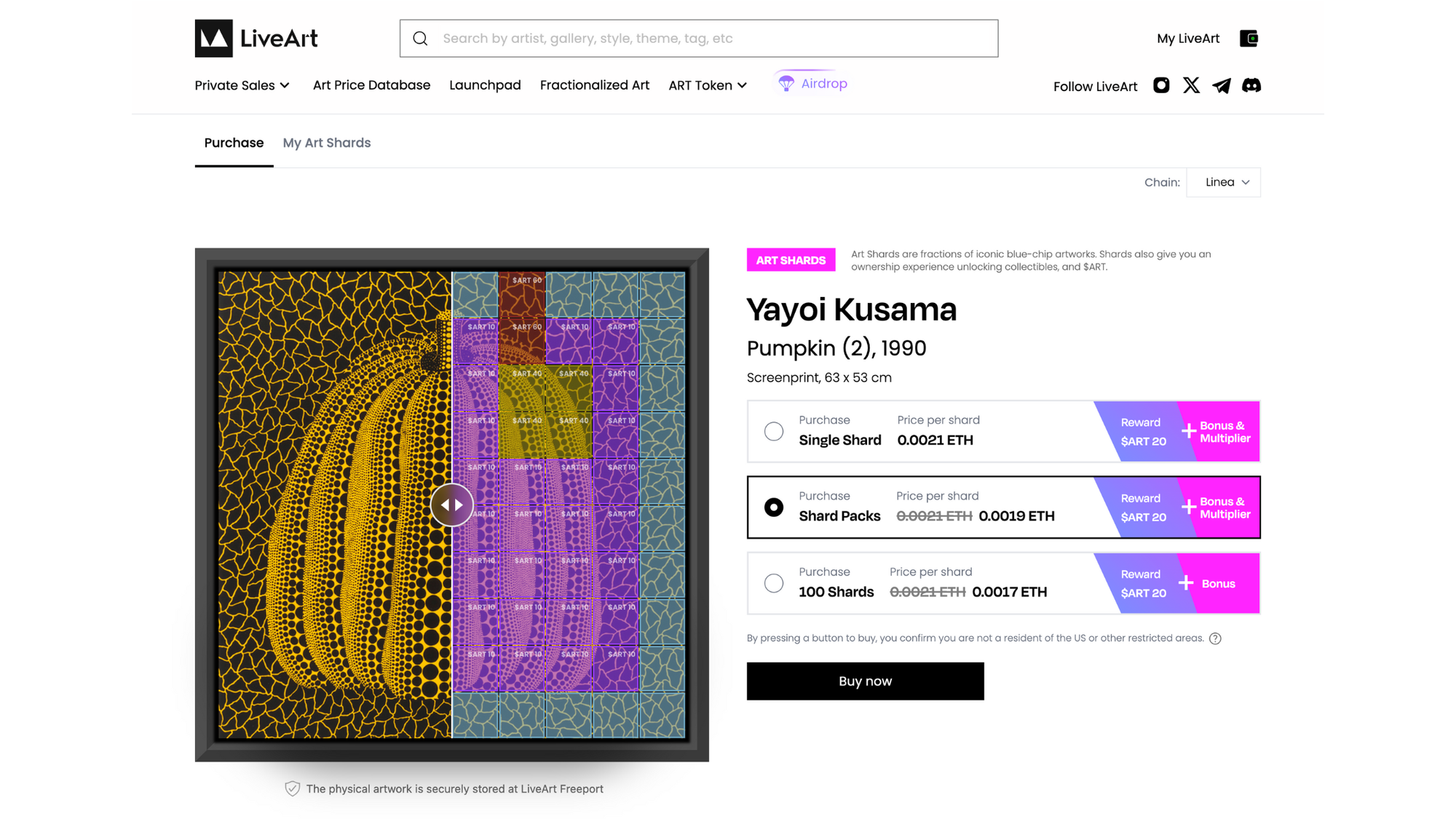

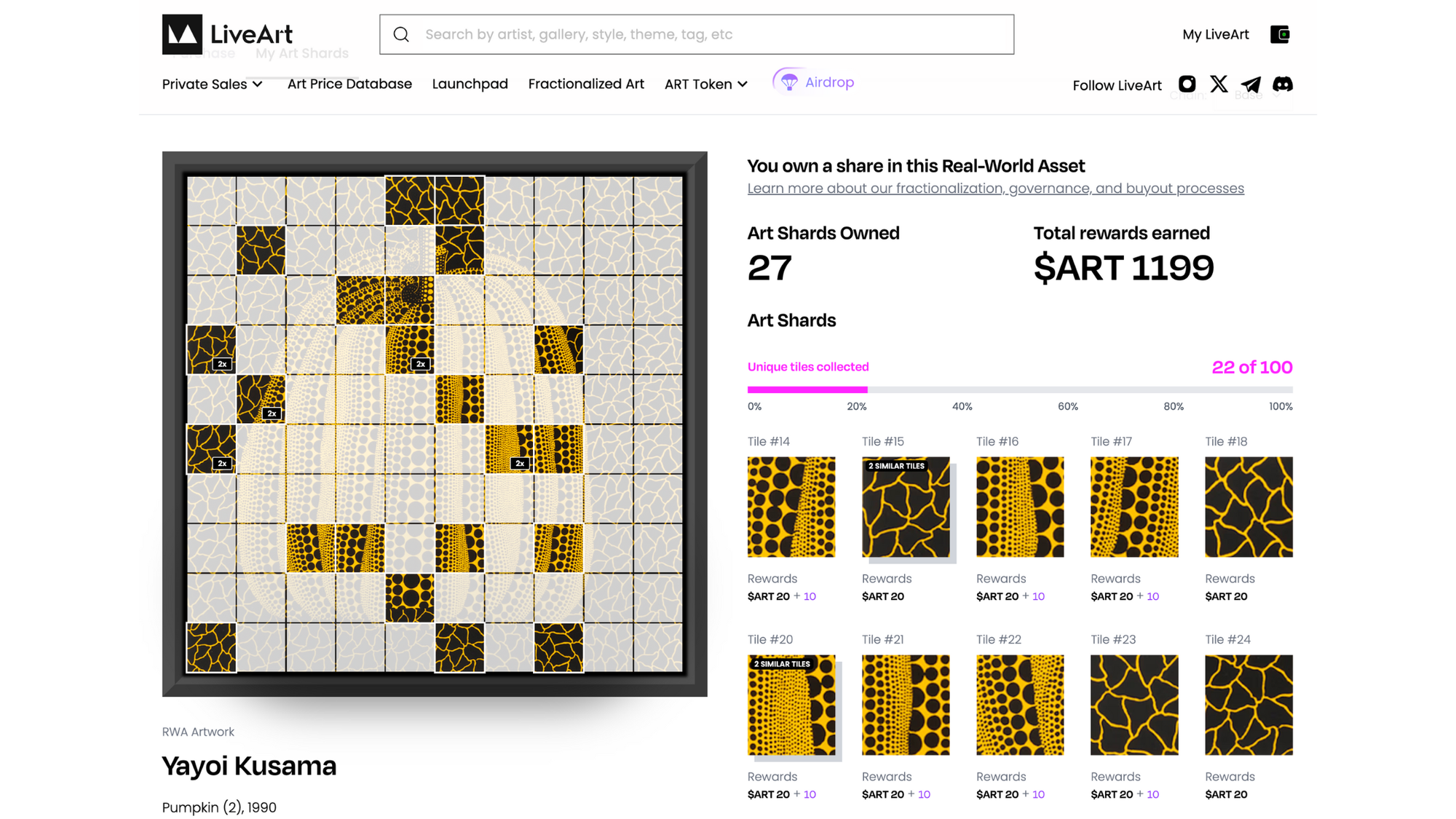

2. AI-Powered Tokenization & Fractionalization

Once acquired, assets undergo tokenization, converting them into digital representations on the blockchain.

Each asset is fractionalized into Shards, digital tokens that grant holders proportional ownership in the underlying real-world item.Each Shard contains an Asset Token, an ERC-20 compatible token, whose initial valuation is determined based on the asset’s appraised market value and LiveArt’s AI-driven risk-adjusted pricing models.

This ensures a fair, transparent, and data-backed valuation process, reducing speculation and enhancing market confidence.Through fractionalization, LiveArt enables investors to own a share of high-value assets, removing the barriers of high capital requirements that have historically restricted access to the fine art and luxury markets.

3. Initial Asset Offering (IAO)

To introduce fractionalized assets to the market, LiveArt conducts an Initial Asset Offering (IAO), an on-chain event where investors can purchase Shards. These offerings occur through various methods, including fixed-price sales or auction-based models, depending on demand and asset type.

IAOs take place across multiple blockchain ecosystems, including Ethereum, BNB Chain, Polygon, Avalanche, and other partner chains, ensuring broad market accessibility. Additionally, 20% of each IAO’s supply is allocated to LiveArt’s DEX liquidity pools, providing immediate secondary market trading opportunities while maintaining fair price discovery.

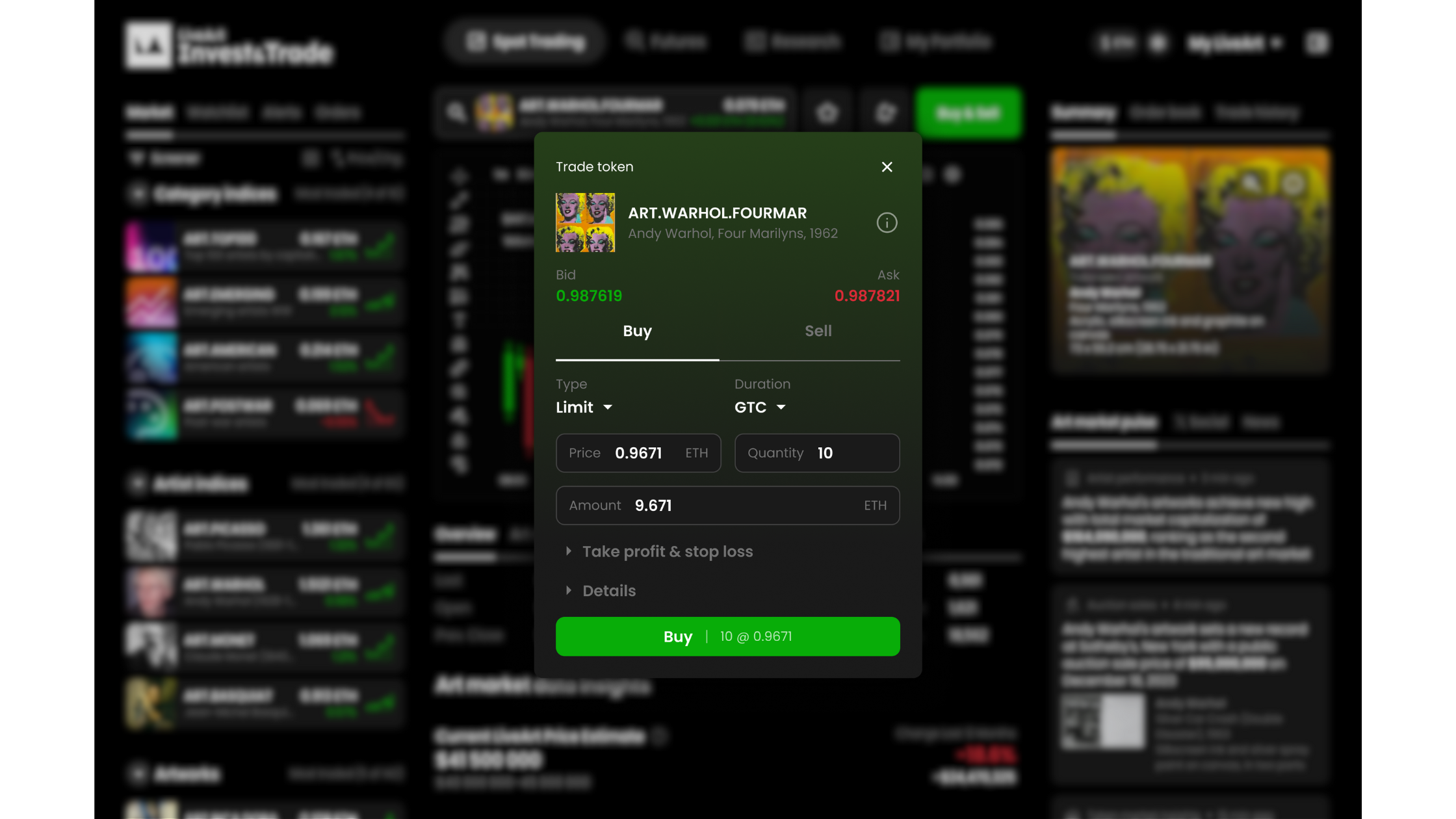

4. AI-Enhanced Trading & Liquidity

LiveArt operates a decentralized exchange (DEX) on ArtChain, facilitating seamless trading of fractionalized Shards and other tokenized RWAs.

Unlike traditional art and luxury markets, where liquidity is scarce, LiveArt’s AI-powered DEX dynamically adjusts market conditions to optimize liquidity and trading efficiency.

The AI continuously analyzes order book depth, market sentiment, and trading activity, enabling it to refine price discovery, mitigate slippage, and enhance overall trading efficiency. Bridging solutions ensure that Asset Tokens can be easily transferred across chains and traded securely on the LiveArt DEX.

5. Custody & Asset Management

To safeguard the integrity of tokenized assets, LiveArt employs a network of secure freeport storage facilities, ensuring that physical assets are protected under institutional-grade security standards.

These custodians are responsible for storage, insurance, authentication, and logistics, all of which are monitored by AI-driven verification systems.

The LiveArt Foundation oversees all aspects of asset custody, ensuring compliance with regulatory requirements, transparent ownership tracking, and secure asset movement between entities when required.

6. AI-Enabled DeFi & Structured Products

LiveArt extends the utility of its tokenized assets through AI-driven DeFi products and structured financial instruments. These include:

- RWA indices: Bundling multiple tokenized assets into diversified investment portfolios.

- Lending & borrowing protocols: Enabling users to collateralize tokenized assets for on-chain loans.

- Derivatives & futures trading: AI-optimized structured financial products for institutional-grade investment strategies.

Through AI-powered portfolio allocation models, investors gain tailored investment insights, helping them optimize asset allocation, risk exposure, and long-term portfolio performance.

Token Utility and Value Accrual

Spending $ART

- Gas Fees on ArtChain

- Trading & Purchasing Fractional RWAs

- Participating in IAOs

- AI-Powered Portfolio Optimization & Risk Management

- DeFi Products: Art & Luxury Asset Indices, Lending, and Structured Funds

- Custody & Insurance Fees for Physical Assets

Earning $ART

- Fractional Sales & Trading Fees

- Staking & Yield Rewards

- Liquidity Provision on LiveArt DEX

- Data Contributions to LiveArt AI Agent

- Institutional DeFi Participation

Deflationary Mechanisms

- Buyback Programs - revenue from platform fees is used to buy back and burn $ART, permanently reducing supply and ensuring long-term deflationary pressure.

- Dynamic Fee Redistribution - trading fees are redistributed to stakers and token holders, encouraging reinvestment and limiting sell pressure.

- Staking and Locking - longer staking periods and higher-tier memberships yield higher rewards, reducing token circulation.

LiveArt Ecosystem: Partnerships, Channels & Distribution

LiveArt is building a robust ecosystem by collaborating with key partners across multiple verticals. These partnerships enhance liquidity, expand access, and drive adoption of AI-powered RWA investing.

Multi-Chain Blockchain Ecosystem

✅ LiveArt is deployed across Ethereum, Base, BNB Chain, Polygon, TON, Linea, and Bitcoin Ordinals.

✅ Integration with cross-chain interoperability solutions (such as LayerZero) ensures seamless asset transfers.

✅ Enables a borderless and scalable tokenized asset marketplace.

Web3 Wallets & Identity Providers

✅ Partnerships with leading crypto wallets (such as OKX Wallet) ensure secure and seamless transactions.

✅ Collaborations with AI-driven identity solutions (such as Aspecta) enable trustless verification for high-value asset trading.

✅ Strengthens security, compliance, and accessibility for investors entering ArtFi markets.

AI Agents & Platforms

✅ Partnerships with AI Agent platforms to integrate cutting-edge AI-driven investment models.

✅ Enables AI-powered portfolio management, automated trading strategies, and predictive market analytics for tokenized assets.

✅ Expands LiveArt’s capabilities by leveraging decentralized AI networks to enhance price discovery and liquidity forecasting.

Top Altcoins & Memecoins

✅ Strategic deals with top altcoins and memecoins to introduce cashback rewards, staking bonuses, and token incentives on LiveArt projects.

✅ Drives cross-community engagement, allowing major token ecosystems to interact with tokenized RWAs and high-value digital assets.

✅ Expands utility for $ART and strengthens liquidity by integrating altcoin-based transaction mechanisms and DeFi rewards.

RWA Marketplaces

✅ Strategic alliances with RWA trading platforms allow seamless buying, selling, and trading of tokenized assets.

✅ Expands the reach of fractionalized fine art and luxury collectibles to Web3-native audiences.

✅ Ensures secondary market liquidity and dynamic price discovery.

DeFi & Liquidity Providers

✅ Collaborations with DeFi lending platforms to enable RWAs as collateral for onchain loans.

✅ Partnerships with liquidity pool providers to create deep and sustainable trading markets.

✅ Integration into structured financial products, bringing RWAs into onchain investment portfolios.

Institutional Partners & Asset Custodians

✅ Works with auction houses, galleries, and art funds to bring institutional-grde assets onchain.

✅ Provides insured, institutional custody solutions for high-value tokenized assets.

✅ Expands adoption among hedge funds, family offices, and traditional investors seeking RWA exposure.