Keith Haring: The Blueprint for Tokenized Pop Culture

Keith Haring didn’t just create art. He created a cultural protocol — one that spans museums, merch, memes, and now, tokenized ownership.

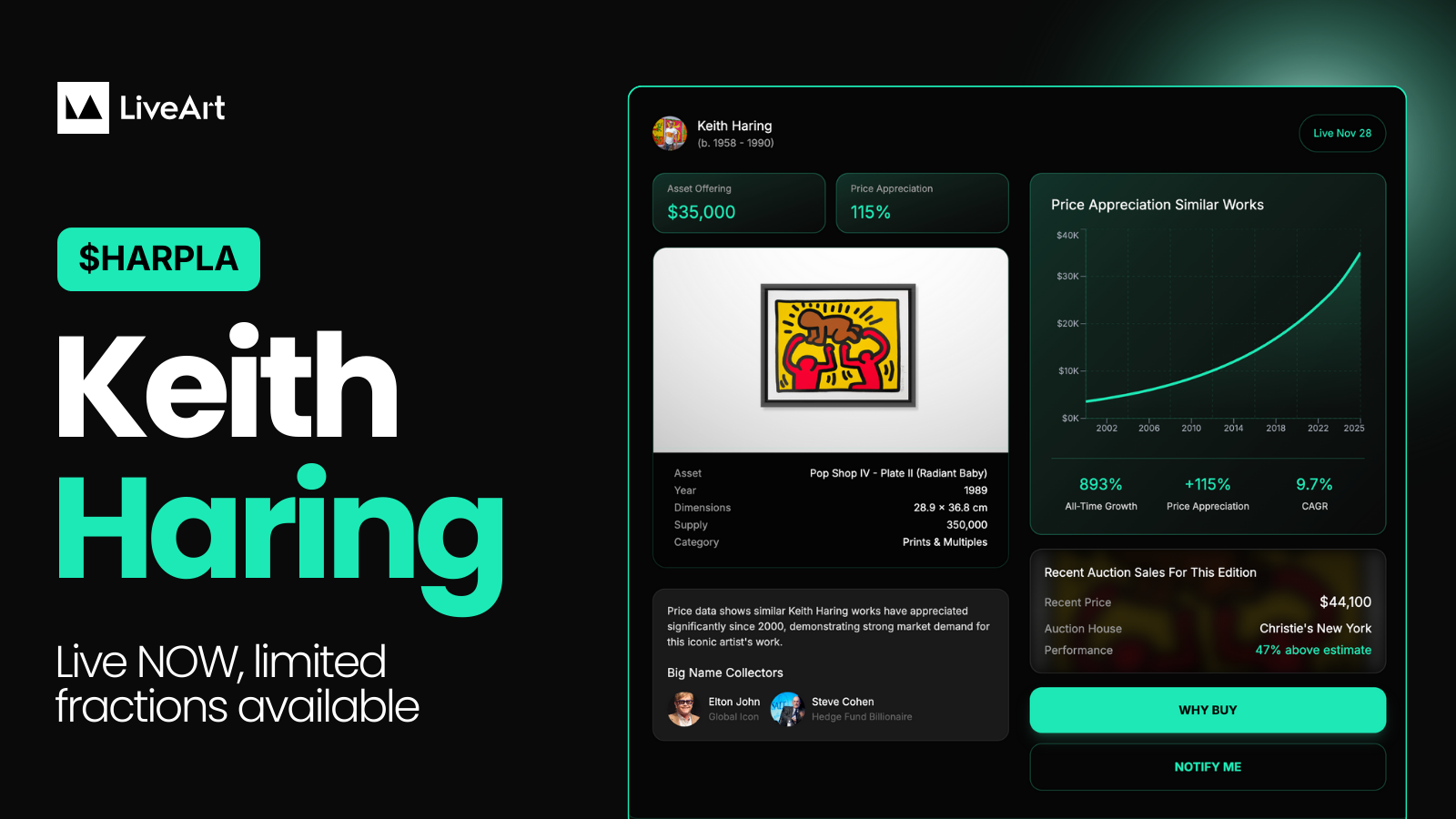

With the launch of $HARPLA, LiveArt brings Haring’s iconic Pop Shop IV – Plate II (Radiant Baby) onchain. This isn’t just another print. It’s the most recognizable motif in Haring’s visual universe — and now, one of the most culturally and economically relevant RWAs available for fractional ownership.

Why Haring Prints Are Built for RWAfi

Keith Haring’s print market already behaves like a decentralized financial system:

- Hundreds of trades per year across all major auction houses

- 8.76% AAGR, with 71–75% sell-through rates

- 893% all-time price growth for comparable editions

- Blue-chip confidence, yet community-level accessibility

These are the exact traits RWA investors look for: liquidity, historical appreciation, cultural stickiness, and real-world volume.

And with editions like Pop Shop IV, that liquidity meets iconography — collectors aren’t just buying art, they’re acquiring symbols.

The Radiant Baby: A Cultural Primitive

Pop Shop IV – Plate II isn’t just a Haring work. It’s the Haring work.

Radiant Baby represents the purest expression of Haring’s language — a globally recognized image that drives demand across:

- Museum retrospectives and gallery exhibitions

- Streetwear capsules, from UNIQLO to Coach

- Public installations and viral marketing moments

- Youth culture, protest art, and Web3-native design

Collectors overwhelmingly favor Radiant Baby when choosing just one Haring print. In tokenized terms, this is prime collateral — high-velocity, high-fandom, and highly divisible.

A Print Market with Real Scale

Since 2015, Haring’s print turnover has more than doubled:

- Total annual print sales peaked around 2022–23

- Even after cooling from the speculative highs, the market stabilized at ~2× its mid-2010s baseline

- In 2024, he recorded 715 auction sales, with graphic works making up ~84% of his lifetime auction volume

This isn’t a market powered by a few trophy lots — it’s a repeatable, data-rich, liquid asset segment ready for onchain products.

Cultural & Institutional Flywheel

Haring’s market momentum is driven by more than just collectors:

- Major exhibitions at The Broad, AGO, and Walker Art Center reinforce global demand

- The Nakamura Keith Haring Collection in Japan keeps visibility high in Asia

- Fashion and lifestyle partnerships (Absolut, Swatch, Converse, MAC) make his imagery omnipresent

- Street installations, like London’s temporary “Haring Cross” station takeover, build brand imprint and visual familiarity

All of this translates into constant cultural pressure driving demand for the original works — especially prints, which offer the clearest path to ownership.

Why $HARPLA Matters for RWA Investors

LiveArt’s fractionalization of Pop Shop IV – Plate II unlocks:

- A globally recognized image with museum-level prestige

- A deep price history suitable for AI oracles and structured DeFi products

- A fractional entry point far below the $35K+ fair market value

- Exposure to one of the most liquid segments of the entire art ecosystem

And with collector-grade branding, iconic status, and institutional backing, this isn’t speculative — it’s a cultural blue chip designed for composability.

Bottom Line

Keith Haring prints are the foundational layer for tokenized Pop culture.

Radiant Baby isn’t just a symbol — it’s a unit of cultural liquidity, tradable and collectible across the world.

With $HARPLA, LiveArt brings that momentum fully onchain.

👉 Explore the Keith Haring drop

🎨 Limited fractions. Real-world demand. Full DeFi utility.